In the volatile world of cryptocurrency, where narratives like “AI meta” or “DePIN meta” come and go like seasonal trends, the “Revenue Meta” has emerged as a timeless anchor. This narrative emphasizes investing in blockchain protocols that generate actual income, rather than relying solely on market speculation.

As of November 2025, with Bitcoin hovering around all-time highs and Ethereum scaling new heights post its latest upgrades, the crypto market is maturing. According to data from DefiLlama and Token Terminal, top revenue-generating protocols collectively raked in billions in fees over the past year, outpacing many traditional market cap-based indices during downturns. But what exactly is the Revenue Meta? Think of it as the blockchain equivalent of investing in profitable companies like Apple or Amazon—instead of betting on unproven startups. It’s a shift from “pump and dump” to “build and earn,” rewarding projects with real utility and cash flow.

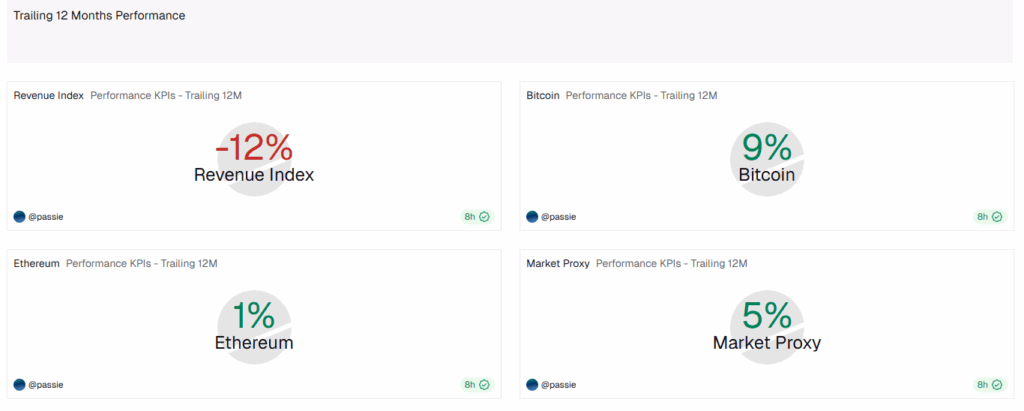

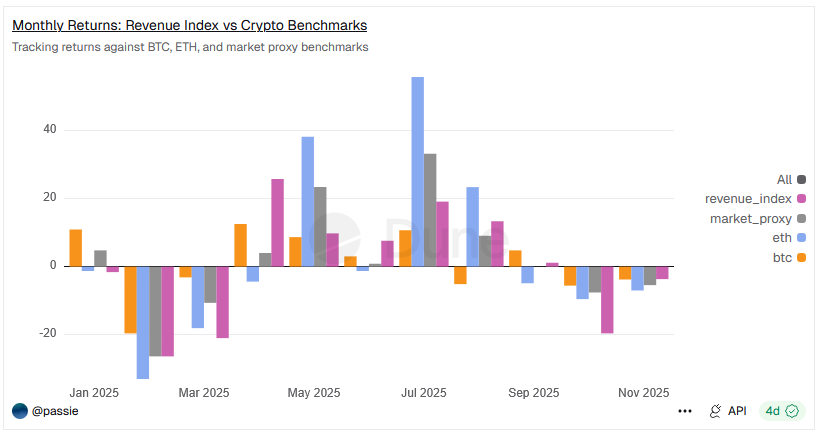

Sometimes the revenue index has outperformed other assets in recent months, although there is still no clear difference.

The Fundamentals: What is the Revenue Meta?

At its core, the Revenue Meta is a crypto narrative—or “meta,” slang for overarching theme—that prioritizes protocols and projects based on their ability to generate and distribute real revenue. Unlike traditional crypto indices that weight assets by market capitalization (e.g., the total value of all tokens in circulation), the Revenue Meta focuses on earnings from on-chain activities like transaction fees, lending interest, or trading volumes.

The Revenue Meta Index dashboard compares the performance of an index composed of the top 10 crypto protocol tokens that generate the most revenue (HYPE, AERO, SKY, JUP, CAKE, BONK, PENDLE, AAVE, RAY, PUMP) against important benchmarks: BTC, ETH, and a Market Proxy (50/50 BTC and ETH).

Historical Origins: From DeFi Summer to Revenue Renaissance

The concept isn’t entirely new. It traces back to the “DeFi Summer” of 2020, when decentralized finance protocols like Uniswap and Aave exploded in popularity. These platforms introduced fee-generating models, where users paid small percentages for swaps or loans, creating a revenue stream for the protocol and its token holders. However, early DeFi was riddled with hype—projects promised astronomical yields without sustainable economics, leading to collapses like the 2022 Terra-Luna debacle.

Fast forward to 2024-2025: As crypto integrated with traditional finance (TradFi), regulators like the U.S. SEC began scrutinizing speculative assets. This pushed the industry toward maturity. Data from a16z’s State of Crypto 2025 report highlights how stablecoins and DeFi apps settled over $772 billion in transactions in September 2025 alone, underscoring real-world utility. The Revenue Meta gained traction amid this shift, with influencers and analysts on platforms like X (formerly Twitter) coining the term to describe the “boring but reliable” path to long-term gains.

Analogy: Imagine the stock market. Would you invest in a company with massive hype but no profits (like many dot-com bubbles), or one with steady earnings? In crypto, revenue acts as that profit metric, signaling protocol health and sustainability.

Technical Breakdown: How Revenue Generation Works Step-by-Step

Blockchain protocols generate revenue through built-in mechanisms. Here’s a step-by-step look:

- User Activity Triggers Fees: Every transaction on a protocol incurs a fee. For example, on a decentralized exchange (DEX) like Uniswap, traders pay 0.05-0.3% per swap. This fee is collected automatically via smart contracts—self-executing code on the blockchain.

- Fee Distribution Models: Protocols decide how to allocate these fees. Common approaches include:

- Burning Tokens: Reducing supply to increase scarcity (e.g., Tron’s TRX burns fees, potentially driving up value).

- Buybacks and Distributions: Using revenue to buy back tokens from the market and distribute them to holders or liquidity providers (e.g., Hyperliquid’s model).

- Staking Rewards: Holders lock tokens to earn a share of fees, creating a “real yield” (e.g., Lido’s stETH for Ethereum staking).

- Tokenomics Integration: Revenue often ties into the project’s token economy. For instance, in “fee-sharing” models, token holders vote on governance and receive dividends. This creates a flywheel: More usage = more revenue = higher token value = more users.

- Measurement and Indexing: Tools like DefiLlama track daily/monthly revenue. The Revenue Meta Index, as visualized on dashboards like Dune.com’s by user @passie, creates an equal-weighted basket of the top 10 revenue earners. It compares this index against benchmarks like Bitcoin (BTC), Ethereum (ETH), and a 50/50 BTC-ETH proxy to test if revenue-focused strategies outperform.

Applications and Real-World Examples: Revenue in Action

The Revenue Meta reveals in practice, where we can observe how protocols with strong earnings models weather market storms. Let’s examine key categories and case studies.

DeFi Protocols

Decentralized finance remains the epicenter. According to CryptoSlate, top protocols generated $1.2 billion in revenue in August 2025, up 9.3% month-over-month.

- Hyperliquid ($HYPE): A Solana-based DEX, Hyperliquid topped charts with $2.85 million in daily revenue (DefiLlama, November 2025). It uses fees for token buybacks, creating a “flywheel” where revenue supports token value. Result? Hyperliquid outperformed Solana by 2x in Q3 2025, per Token Terminal data.

- Uniswap ($UNI): The OG DEX activated fees in 2025, sharing revenue with holders. Monthly revenue hit tens of millions, stabilizing its price amid volatility. Comparison: Uniswap’s revenue model helped it recover faster than non-revenue DEXs like SushiSwap during downturns.

| Rank | Protocol | Category | Monthly Revenue (USD) | Key Revenue Source |

|---|---|---|---|---|

| 1 | Tether (USDT) | Stablecoin | ~$700M | Issuance fees |

| 2 | Circle (USDC) | Stablecoin | ~$240M | Treasury yields |

| 3 | Hyperliquid | DEX/Perps | ~$85M | Trading fees |

| 4 | EdgeX | DeFi | ~$49M | Treasury/holders |

| 5 | Pump.fun (PUMP) | Meme/Launchpad | ~$43M | Launch fees |

| 6 | Tron (TRX) | L1 Blockchain | ~$37M | Burned fees |

| 7 | Ethena (USDe) | Yield Stablecoin | ~$32M (Aug peak) | Yield generation |

| 8 | Aave | Lending | ~$30M | Interest fees |

| 9 | Jupiter | DEX Aggregator | ~$25M | Swap fees |

| 10 | Lido | Staking | ~$20M | Staking rewards |

Stablecoins and Infrastructure: Steady Earners

Stablecoins like Tether and Circle dominate, earning from treasury investments and issuance. In high-inflation environments (e.g., Argentina’s 200%+ inflation in 2023-2024), users flocked to these for stability, boosting revenue.

Case Study: Pump.fun, a Solana launchpad, generated $36.69 million monthly from token launches. Its success? Direct revenue sharing, turning hype into sustainable earnings—unlike failed meme coins.

Comparisons: Pros and Cons of Revenue Meta vs. Market Cap Focus

- Pros: Revenue signals real adoption, reduces pump-dump risks, and provides “real yield” (e.g., 5-20% APY on staked tokens). Per a16z, revenue-backed tokens showed 20-30% better resilience in 2025 drawdowns.

- Cons: Revenue can fluctuate with market activity; not all protocols share fairly (e.g., some hoard fees).

Challenges and Risks: Not All Revenue is Created Equal

While promising, the Revenue Meta isn’t risk-free.

Volatility and Competition

Revenue ties to usage, so bear markets can slash earnings (e.g., DeFi TVL dropped 70% in 2022). Competition is fierce—new protocols like EdgeX challenge incumbents.

Regulatory Hurdles

As seen with Uniswap’s SEC scrutiny in 2025, fee-sharing could blur lines with securities. Solutions: Decentralized governance and transparent models.

Economic Impacts

On a societal level, revenue metas promote financial inclusion but risk centralization if a few protocols dominate. Case Failure: Terra’s algorithmic stablecoin promised yields without sustainable revenue, leading to a $40B wipeout.

Main Conclusions

As appealing as this narrative/strategy may seem, the results show that the almighty Bitcoin has outperformed everything else in crypto, at least so far.

Return comparison (last 12 months and YTD):

– The Revenue Meta index has been volatile and, when compared, its annualized return is only 0.5% (very low compared to BTC 19.3%, ETH 26.6%, Market Proxy 22.9%).

– The index’s volatility is the highest of all (73.3%), reflecting substantially higher risk.

– In terms of Sharpe Ratio (risk-adjusted return), the index is 0 (i.e., it does not compensate for the risk taken), while BTC and ETH perform better in this regard.

Drawdown (maximum decline from highs):

– The Revenue Meta Index and ETH share the deepest maximum decline (both -59%), worse than BTC (-26%) and Market Proxy (-43%).

Correlation:

– The Revenue Meta Index has a high correlation with ETH (0.85), BTC (0.81), and Market Proxy (0.88). In other words, although it diversifies, its performance closely follows the general benchmarks.

Distribution of daily returns:

– The index has a much wider daily range than BTC and ETH, suggesting more potential for large rises and short falls.

Analysis of tokens within the index:

– Some tokens, such as HYPE, stand out for their outstanding annual growth (225%), while others show pronounced negative returns (e.g., JUP, RAY, PENDLE).

– Over the last 30 days, tokens such as AERO have been leaders (+29% monthly), but there are also several with significant declines.

Win Rate vs. benchmarks:

– The index outperforms BTC in 54.55% of months, but only in 45-54% of months vs. ETH and the Market Proxy.

Key conclusions:

– An index based on revenue generation (not market capitalization) may seem more “fundamental,” but in this particular cycle, it has had much more volatility and lower risk-adjusted returns compared to BTC and ETH.

– Diversification within the highest-revenue tokens does not guarantee higher returns or lower drawdowns in bearish cycles.

– High correlation with major assets limits diversification benefits.

– In sideways or positive markets, some token selectivity (HYPE, AAVE, CAKE) could add value, but it exacerbated declines when the worst tokens (JUP, RAY) had prolonged low returns.

Ideal for investors who:

– Seek exposure to revenue-generating protocols.

– Have a high tolerance for risk and volatility.

– Want to compare alternative strategies to classic market cap indices.

Source:

Revenue Meta Index. https://dune.com/passie/revenue-meta-index.

© Cryptopress. For informational purposes only, not offered as advice of any kind.

Latest Content

- What is the Revenue Meta in Crypto?

- Bitcoin Dips Below $100,000 for Third Time in November as Liquidations Top $500 Million

- Why Lighter’s LLP is Defying Dilution in Perp DEXs (34%+ Yield Vault)

- Visa Launches Pilot for Stablecoin Payouts, Boosting Access for Gig Economy Workers

- Powering the Future of Play: Riyadh Welcomes the Global Games Show 2026

Related

- Corporate Bitcoin Holdings: Which companies hold the most Bitcoin? Analyzing major bitcoin adopters and their strategies....

- Low-Fee Crypto Payment Processor FinAssets Decreases Transaction Fees — From 0.40% to 0.20% GLOBAL — November 12, 2025 — Finassets, a trusted low-fee B2B crypto payment processor, has announced a significant fee reduction for new users. The company’s starting fee for crypto payment transactions has dropped from 0.75% to 0.4%, offering immediate savings...

- Plasma: The Blockchain Challenging DeFi’s Stablecoin Status Quo Plasma aims to offer zero-fee USDT transactions and lightning-fast settlement by leveraging Bitcoin's security and an EVM-compatible environment....

- Crypto Events Archive A growing list of past crypto and blockchain events from around the world. Conferences, workshops, meetups, hackathons, conferences....